Boardroom Premium

As pressures grow, directors need clearer oversight of the decisions and systems that support long-term value, resilience and services.

New Zealand’s infrastructure faces rising strain from ageing assets, severe weather events and constrained funding place pressuring the services that communities rely on. When assets underperform or fail, organisations face service interruptions, rising costs and the risk of reduced revenue, all of which challenge long-term sustainability.

Recent commentary from the Infrastructure Commission and Ministers has highlighted that governance of asset management needs to be strengthened in many organisations. Boards often lack clear and consistent visibility of how well their assets are understood and managed. Now is the time for boards to build clearer oversight of the assets that shape performance, resilience and the value an organisation can deliver, which brings the conversation back to purpose itself.

Every organisation exists to create value for its stakeholders. Directors serve that purpose by acting as stewards of the assets that enable services and growth. While they don’t manage assets day to day, directors must ensure that assets are planned, funded and cared for in ways that sustain value over time.

Good governance provides the structure that makes this happen. It shapes how boards set investment priorities, define what reliable information looks like, and make trade-offs and accountabilities clear. With these foundations in place, boards gain the visibility and confidence to approve credible plans, challenge where needed, and ensure the organisation delivers dependable services, strong value and long-term resilience.

The starting point is building awareness around the board table of what asset management is and why it matters. It’s not just technical – it’s how an organisation understands the assets it relies on, the risks it carries and the opportunities it can unlock.

For directors, this awareness creates context. It turns asset management from an operational topic into a governance responsibility, in a similar way to health and safety management. Once that shift happens, boards can start asking sharper questions:

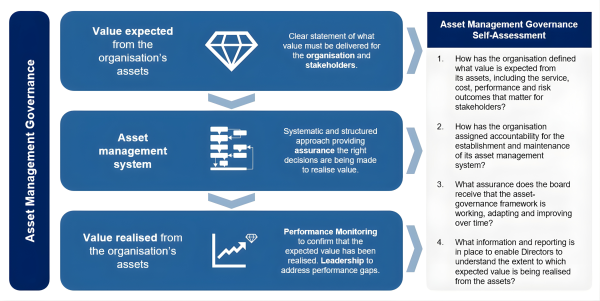

Once those first questions are on the table, directors often want a clearer sense of what effective asset governance looks like. A helpful way to think about it is to follow the path from the value the organisation expects its assets to deliver, to the systems and capability that support those assets, and then to the value that is ultimately realised.

This simple progression helps directors see the patterns behind the information they receive. When the organisation has clear expectations, a coherent way of managing its assets, and reporting that links risk, performance and cost, boards can be confident that asset management is contributing to the organisation’s purpose.

When any part of this picture is uncertain or incomplete, it’s a prompt to seek better insight. Clarity helps the board judge where attention is needed and where assurance may need to be strengthened.

Stronger practice often begins with how boards keep asset matters in view. Oversight becomes more effective when these challenges return to the table regularly, not only when a major decision is required.

Treating asset questions as part of the natural rhythm of governance helps directors notice when pressures are building, or when assumptions are starting to shift. When board attention becomes infrequent or delayed, the cost of inaction tends to appear quietly – through missed signals, slower responses and value that becomes harder to protect. These quiet signals underline why directors play a central role in the long-term care of an organisation’s assets.

Effective asset stewardship strengthens the relationship between an organisation and the people who rely on the services those assets make possible. When boards remain engaged with the long-term consequences of their asset decisions, they help ensure value is protected and opportunities are not lost through delay.

This steady attention supports more reliable outcomes and reinforces confidence in the organisation’s ability to deliver over time. In a period of increasing pressure on infrastructure, it’s this long-term perspective that enables boards to guide organisations with confidence and care.