Great expectations

In an era of climate change litigation, the duties of directors will evolve to reflect changing social expectations.

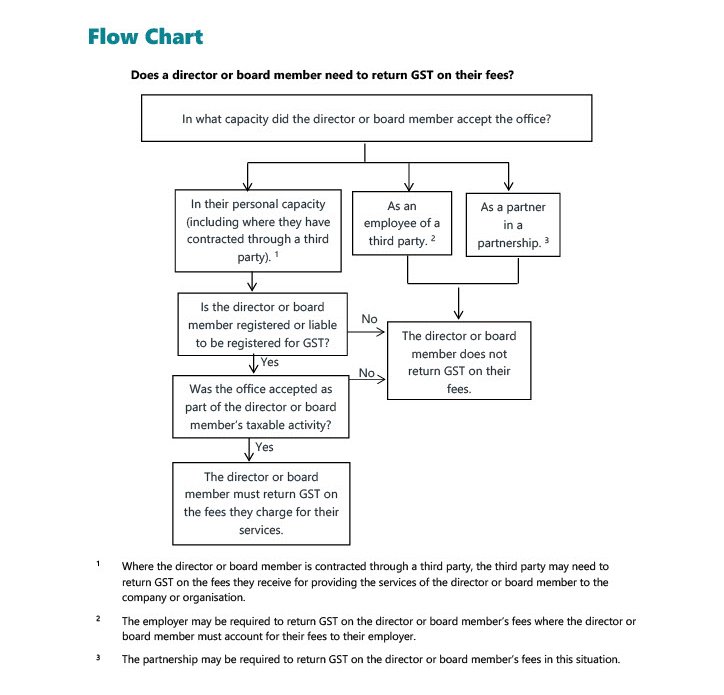

Inland Revenue issued rulings about directors’ fees and GST intended as a welcome clarification. The new rulings will require some directors to review the arrangements they have for invoicing public and private sector organisations on which they sit on the boards. In some cases, this will require deregistering for GST. The main changes are outlined through a legal lens below, followed by a discussion of some of the common situations directors may be in and the practical changes that are required in those circumstances. The rulings will apply from 1 April 2023.

You’re a professional director being paid director’s fees. Should you be charging GST on those fees? And if so, does that mean that you need to be registered for GST?

The position on that has not been as clear as it could be, so the recent release of three clarifying rulings has been welcome.

The short answer is: if you’re not carrying on any other form of taxable activity, then NO, you’re not eligible to register.

That means: if you have no other business, you’re not eligible and you should not be registered for GST. (Furthermore, if you’ve done so simply for this purpose, you’ll be required to deregister, although not retrospectively.)

Importantly, this also means you won’t be in a position to claim GST input credits in relation to your expenses.

But what if you’re an employee of a company and you’ve been appointed as a director of the company as part of your employment? The same reasoning applies here: if you’re not carrying on any other form of taxable activity, then no you’re not eligible to register for GST in respect of this activity. Care needs to be taken though by the employing company, which may still be required to charge GST on the supply of your services. Further guidance on this scenario is expected from Inland Revenue.

Likewise, if you’ve been appointed by the Governor General or the Governor-General in Council — that’s to say: appointed to the Board of a Crown entity or statutory body — the fees for these services will never be subject to GST.

However: if you’re performing your role as part of a broader business - let’s say you’re a partner in an accounting or law firm serving as a director for one of your clients - GST should be charged (except in the Crown entity context).

So where does this leave you if you’re not eligible but had registered anyway? If you’re currently registered for and charging GST, Inland Revenue won’t seek to adjust your prior GST returns. But you’re now expected to deregister and stop charging (and claiming back) GST, with a current deadline of June 30.

For more of the specifics, the IRD has a fact sheet here .

And for a quick eligibility test, they’ve also provided this flow chart.

The Commissioner of Inland Revenue has provided an "operational position", along with fact sheets which will be useful for Directors to guide the questions they ask professional advisers about their situation.

The Commissioner’s operational position says that he does not consider the ruling to change Inland Revenue’s view of GST on professional directors’ and Board members’ fees.

Importantly for professional directors and board members, the Commissioner comments “…that some professional directors [and board members] are registered for GST, having incorrectly taken the view that they are carrying on a taxable activity.”

This could be a significant change for some, and potentially many, directors and board members, despite the Commissioner’s view that the position is not changing.

For that reason, directors should review their situation and seek professional advice to ensure the rulings are complied with when they become effective on 1 April 2023.