Are you telling the full story?

A stunning 87% of Kiwi CEOs believe major global social and environmental challenges such as income inequality and climate change are a threat to their company’s long-term growth and value. Globally the figure is 72%, suggesting that we are feeling this more acutely in New Zealand.

Yet our survey suggests that many New Zealand business still have a way to go when it comes to identifying and defining ESG metrics and information to facilitate strategy, track implementation and inform key stakeholders through reporting and disclosure. Identifying what to measure for impact early in the ESG journey will ensure efforts are delivering towards the organisation’s purpose and unlocking the most opportunity.

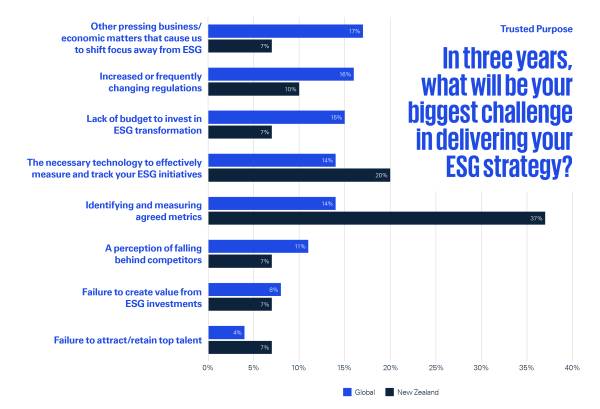

Given the plethora of reporting standards and frameworks available, the fact that 37% of local CEOs surveyed highlight identifying and measuring agreed metrics as their biggest challenge in delivering their ESG strategy may not be surprising. But why do only 14% of global CEOs agree that this is the biggest challenge?

We are behind some international peers in reporting, despite being the first country to mandate climate-related disclosures.

Locally, CEOs also believe more strongly that increased worldwide geopolitics have affected their ESG strategies or plans compared to their international counterparts (47% versus 21% strongly agree). This uncertainty or shift in priorities may have contributed to difficulty in identifying meaningful metrics.

But if we consider the second-biggest challenge - technology that can measure and track ESG initiatives – the issue becomes broader and predates recent global turbulence. Based on this, 57% of New Zealand CEOs are struggling with ESG measurement in some way. Guidance is certainly a critical piece of the reporting puzzle, but developing key metrics and, more importantly, operationalising ESG plans also need the right data and capability in-house. Organisations are only just beginning to invest in data platforms needed to help collate and analyse the broad spectrum of data captured under ESG and this is likely hampering progress to date.

A higher bar

Regardless of the origin of impediments to measuring and reporting progress, the pressure is already on. 83% of Kiwi CEOs are seeing a significant demand from their stakeholders for ESG reporting and transparency. In New Zealand, this is being driven by employees and new hires according to 40% of CEOs, versus 26% globally.

This has certainly been on the rise in the aftermath of Covid-19 as the labour market tightened. Heightened awareness of the urgency of global ESG challenges and greater expectations for employer transparency has led to many employees looking for employers with stronger alignment to their values. The full scope of ESG goes beyond carbon emissions, covering areas such as procurement practices, biodiversity, inclusion and diversity, and governance. It is undoubtedly complex, and there has been a tendency to be selective and focus on reporting positive progress. However, with increased scrutiny and demand for disclosure, the need for transparency has never been greater. Reporting on performance (or lack thereof) needs to be balanced to mitigate confusion or misleading messaging.

This challenge in communication was not lost on the leaders we surveyed; two-thirds are either struggling to articulate a compelling ESG story (37%) or match the rigour of financial reporting (30%). To address these challenges there are steps that can be taken:

- Educate your organisation on ESG risks and opportunities, and what they mean for your organisation.

- Establish a board-led governance structure that fully integrates ESG issues into core activities.

- Build organisational capabilities to understand and respond to the challenges ahead. This extends beyond hiring new skillsets to ensuring existing leaders and managers are equipped to incorporate new thinking into what they do.

- Develop business cases and strategic responses based on the counterfactual, not the status quo. Reframe “compliance costs” as investments in opportunities, building resilience and long-term value.

Achieving progress in these areas is a long game focused on substantive steps. With increasing concerns of “greenwash”, stakeholders should welcome greater transparency including clarity around areas with slower progress – we can only move forward by shining a light on what is holding us back. CEOs who wish to be leaders in this area and respond to the demands of their stakeholders should take note. The time for talk and selective communication is over. A compelling ESG story needs to be balanced, complete and focused on actions.

This article features in KPMG NZ's CEO Outlook 2022.

About the authors

Simon Wilkins is Head of KPMG IMPACT in New Zealand. This is part of a global network that is dedicated to partnering with our clients to address the biggest issues facing our planet, enable growth with purpose, and have a real and positive impact towards the UN's Sustainable Development Goals. In New Zealand, this is a core part of fuelling prosperity for our country and communities. Simon’s role is to lead the firm in supporting transformational change in business, government and the wider community across five related domains: Economic and Social Development; Climate Change and Decarbonisation; ESG & Sustainability; Sustainable Finance; and Measurement, Assurance and Reporting.

Ronja Lidenhammar is responsible for delivering climate change and decarbonisation projects at KPMG. Ronja has more than 8 years’ experience working with organisations to build the business case for sustainability. She has worked across both industry and the public sector, accelerating strategic and operational environmental solutions in New Zealand with a core focus on decarbonisation and waste management.