Why inclusion belongs in the boardroom

Pride Month is a reminder that LGBTQIA+ inclusion isn’t just the right thing to do – it’s good governance.

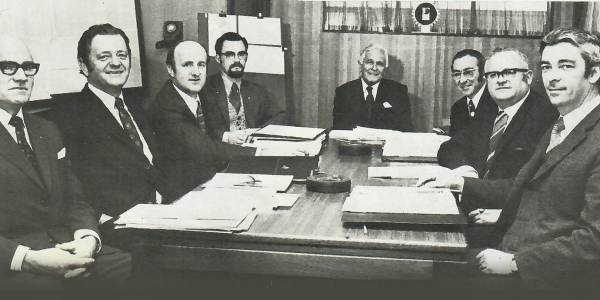

Victor Hugo Bedford MInstD has a governance career spanning 50 years and is the longest standing member of the IoD.

Named after a famous French poet, Auckland-based Victor Hugo Bedford MInstD - more commonly known as Hugo - is the longest standing member of the Institute of Directors.

His governance career began more than 50 years ago when he joined Campbell Motors in 1963 - the same board his father had retired from the previous year.

“I've been on all sorts of boards with all sorts of people and with a wide range of fellow directors. Some fantastic people who helped me a lot,” he says.

His portfolio would later include big corporate bodies -Toyota Limited and Steel Bros in Christchurch - New Zealand’s leading motor body building and engineering company who ran one of two assembly plants for Toyota. He was also the executive director of two large manufacturing companies in India and travelled there many times.

When Bedford became a member of IoD in 1971, it was about building a foundation of knowledge and arming himself with as much information as possible to take into the boardroom.

Along the way, he also discovered other members who inspired him. In the 1970s he sat alongside the likes of Sir Clifford Plimmer (great grandson of pioneer John Plimmer and Chair of Wright Stephenson and Company), pre-eminent business leader, Sir Ron Trotter, and Walter Hadley.

"They were extraordinary directors,” says Bedford.

But it was Walter Hadley who he admired the most.

“He was without a doubt the most honest, determined and direct Director I've ever met. He was also respectful to both sides - shareholders and the general public. He was terrific and taught me a lot.”

Mentors and inspirational people aside, sitting in the boardroom and keeping any company afloat is never easy.

“I think the responsibility is very real because you’re dealing with other people's lives and money. And that, in my opinion, is a great responsibility.”

Over time, one of the biggest changes he has seen is an increase in responsibility and penalties put in place. He says in the past, directors weren’t held to account for any decisions or actions made in or out of the boardroom.

“When I joined you could do what you jolly well liked and it didn't matter a damn. I think the responsibility of the shareholders is very important, and even today, the boards are rather haughty and dismissive of the shareholders, which is not good,” Bedford says.

He insists knowing your responsibilities is essential in order to keep up with change, as well as not falling into the temptation of making snap decisions, which he says is happening far too often with the rapid rate of incoming issues and constant change. In his eyes, that doesn’t serve the best interests of the company or the outcome. But he says trying to slow things down is next to impossible and he warns directors could make better, more effective and informed decisions by taking control of the reins.

“I’m not always happy with the results or the way they’re handled...you need to think about everything that's being said and do some research. That’s probably the most important thing on a board.”

“I still read Boardroom magazine when it comes because there are an awful lot of people out there who know what they're talking about.”

Bedford believes the best boards have the right people, and that finding people who possess a sound knowledge of the product or business should always be a top priority.

“You want to have the people who can get you out of the poo if the company gets into trouble...and you need to make a reasonable profit - it's never been easy. I don't believe in making a fortune out of anybody, but you'll get to stay alive.”

And while he recognises that diversity and gender on boards is a hot topic, he adds that should always be secondary.

"That's why you have more than one director because not everyone knows everything. If I can find someone who has the knowledge, I wouldn't care if there were ten women and one man [on a board], or whether they are green, blue...short. In my opinion, you want the expertise.”