IMHO: Getting on top of supply chain emissions

Blockchain and the future of supply chains, ESG traceability and reporting.

We need better data to mitigate emissions and access quality offsets

As pressure grows for companies and governments to shift gears on emissions management to chart a pathway towards 1.5°, there is no doubt that the urgency and intensity around climate performance, verified stewardship and data-led innovation is a priority.

Although companies have been making progress around scope 1 and 2 planning, we need to lean into climate data with more urgency and intensity to meet climate expectations from investors, customers and consumers.

We have seen scrutiny around greenwashing, and more recently greenhushing (where companies under-report or remain quiet about their sustainability performance through fear of drawing attention or scrutiny to their claims). Both greenwashing and greenhushing point to a general lack of transparency in the operational sustainability data companies use to make claims.

As we transition towards decarbonisation, it’s abundantly clear that high-emitting sectors cannot meet their government-mandated nationally determined contribution (NDC) commitments in the designated time-frames without access to offsets. We need a more mature and better-credentialised approach to mitigations, and availability of and access to high quality offsets. The quality and depth of data supporting accreditation of new offset protocols here in New Zealand is a significant impediment.

Looking ahead

As we approach 2023, we should expect a continuation and intensification of ESG (with particular urgency around the E and S) from investors, customers and, frankly, from all stakeholders.

Focus areas for your business in 2023 and beyond:

- Supply chain – understanding and mitigating Scope 3 (and soon Scope 4) emissions in your supply chains.

- The pathway to 1.5° – very challenging from current baselines.

- ESG footprints – standards organisations such as the XRB are working on more universal settings as these will be essential to scale interoperable emissions targets.

- Compulsory Climate Disclosures – this will expose data gaps down-stream and comes online in Jan 2023.

- Removals and avoidance strategies/investments – tracking efficient, low-cost conversion of mitigations to your emissions ledger.

- Avoidance of double accounting emissions ("my Scope 1 is your Scope 3!").

- BCA (Border Carbon Adjustments) or CBAM (Carbon Border Adjustment Measures). These are quite specific and therefore only directly impact a small group of companies directly but indirectly they are strong signal to businesses regarding the lack of appetite from markets, investors and customers for embedded emissions. Directors may think CBAM and BCA do not apply to their companies, but in reality you should be prepared to deal with embedded carbon in your products because border carbon will likely become an issue for all products with a material carbon content.

A great example of indirect BCA is highlighted in a recent Stuff article in which Fonterra indicated they need to map their Scope 3 emissions to respond to growing customer concerns over embedded carbon in products crossing borders.

The language coming out of COP27 is changing towards far greater urgency. There are calls for a new direction in a new era of implementation to drive greater climate progress and greater accountability for that progress.

Targeting our efforts towards solutions, reducing duplication of effort (where companies duplicate the discovery and learning process around emissions and sustainability in silos) and adding greater accessibility to the latest data knowledge and tools, will be central to the “new era of implementation”.

Boards and management of companies that are leaders in supply chains can take a leadership role through the data-led Scope 3 Greenhouse gas (GHG) mechanism to help remove the accessibility barriers to emissions and sustainability reporting, and emission tracking with their upstream and downstream suppliers and customers.

Access to markets

New policy leadership from major markets presents issues for products with embedded emissions. CBAM and BCA coming out of the EU are likely to be adopted in many major markets. This has led to discussion around new models, for example “carbon clubs”, where countries get together and set carbon pricing to align and balance trade flows so there is minimal disruption.

These carbon clubs are leading to unexpected and unforeseen challenges.

The following are examples of steps being taken by organisations that are leading to border carbon and embedded carbon barriers.

City of London. After completing research into food emissions, The City of London (CoL) found that meat products were 5% of the total supply chain but circa 27% of all food-related emissions. As a result, CoL locked in policy to reduce meat products in the CoL-controlled assets by 50% by 2025. As 99% of meat products are imported from outside the city boundary, this will impact many suppliers.

Lidl Grocery. Swedish grocery chain Lidl Grocery announced it will stop airfreighting fruit and vegetables to their stores. This presents problems for products vulnerable to post-harvest time sensitivities. The signal for food suppliers here is what risk embedded emissions pose to the continuation of market access.

We may be doing a good job inside our own company boundaries, but pressure is building worldwide from investors and consumers on supply chains.

Blockchain can help us meet future climate expectations of our stakeholders

Documenting and reducing embedded emissions and urgency around mitigation and reduction will be central to the next phase of climate data. Do we have enough of the "right" data and the processing power to build future solutions to meet these challenges?

With access to blockchain technology, we have the potential to log, timestamp and authenticate millions of data points in real time. Blockchain can enable us to create a 360-degree view of ESG (including Scope 3 and future Scope 4) and authenticate provenance of emissions. This, matched with the right data, can play a significant role in preparation to meet future challenges.

What does 360 degrees of data look like?

Think about the volume and quality of data and the visibility of the data that autonomous vehicles need in order to operate without hitting objects. It’s an abstract analogy in comparison to climate data, but its points towards accuracy, integrity and depth of all data inputs that allow a neural processor to see enough information in real time to guide the car safely along the road. In our own work at Blocktrac we think with enough of the right climate data available in real-time, we can create “driverless” emissions dashboards and compliance and leave the directors and management to dedicate time to strategy, planning and decarbonisation.

Still not clear on blockchain?

Blockchain came into existence as the technology that supported Bitcoin, cryptocurrencies, and, more recently, NFTs, developed through a peer-to-peer network of nodes. However, blockchain technology enables many use cases with unique features far beyond cryptocurrency.

Key blockchain features

- Blockchain is a shared database that enables multiple parties to input data in real time. This data is verified, time-stamped, secure and available to be accessed by multiple (authorised) parties in real-time.

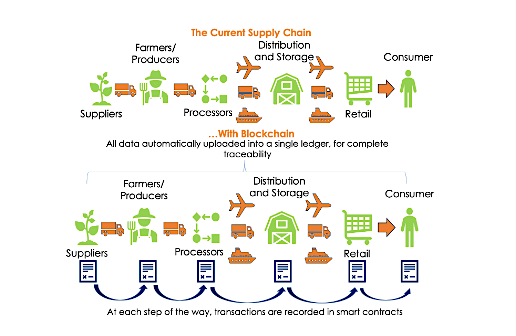

- Data can be received to the ledger from multiple sources, including millions of IoT (Internet of Things) data points, logged and authenticated in real-time. For example, it is ideal for freight supply chains to track goods, authenticate and certify provenance from production to user.

- Many items – many SKUs, parts, chemicals, materials that are products or form part of a final product.

- Many steps – from production inputs, to, production, to manufacturing, packaging, etc.

- Many contributors - inputs suppliers, materials producers, processors, warehouses, freight forwarders, retailers, consumers.

- Multiple verification gates – raw materials, production, processing, quality assurance, receipt into bonded warehouse, arrival to market, shipped to store.

- Smart contracts. Blockchain technology enables code (smart contracts) to automate data to be sent and verified. These contracts enable real-world assets to be identified and traded on blockchains.

- Interoperability is a major feature of blockchain technology distributed ledger versus centralised data where data is buried in a central system.

Example. An agriculture supply chain solution built on our blockchain network. Imagine how many individual data points exist in the supply chain below to track products and verify provenance.

Blockchain can help you get on top of your organisation's supply chain ESG

With Blocktrac we are already digitising real world assets (carbon offsets) onto the blockchain represented by a cryptographic unique ID number. This enables credentialled verification transparency and price discovery. Customers can then buy, store, sell, or trade high quality verified VCM offsets in FIAT currency on the platform. It also avoids double accounting and ensures secure and transparent ownership.

For supply chain provenance, blockchain technology enables producers to reliably track data from beginning to end, flow that data through the supply chain and include third party verification for continued verification of production practises, thus allowing for full traceability.

Blockchain can also be used to onboard, catalogue, track and trace Scope 1, 2 and 3 GHG emissions and can help organisations transition from Scope 1 and 2 GHG emissions factor data to real-time actual emissions data.

Are you ready for blockchain?

The messaging around the nature of blockchain technology and the distributed ledger, decentralised features might be seen as incongruous with more traditional concepts of data, control, privacy and centralisation. This might raise concerns for governance practitioners around privacy, safety, transparency, security.

But blockchain infrastructure already supports circa 2 trillion USD in digital assets. Real work assets total around 300 trillion USD. So, digitising routine business activities and sharing data to complete a digital picture of business activities in supply chains is already here and expanding. Blockchain will stand out as the technology to provide this digital view and will, in our view, outperform any comparative centralised siloed databases.

With themes emerging for 2023 around climate data integrations and far greater expectations around transparent accountability, New Zealand companies will need advanced data solutions such as blockchain to match their international peers in recording, measuring, authenticating and sharing supply chain ESG data.

About the author

Adrian Bosher has fifteen years providing investment strategy for private family offices/business investors between New Zealand and Southeast Asia and China, food processing, fintech and agri-digital technologies.

Adrian is cofounder of New Zealand Asia Agritech, a tech start-up developing and adapting digital technology suite to improve farm production in Southeast Asia. New Zealand Asia Agritech was invited by the Thailand Government to enter the first MOU between the government and Private companies to advance digital technology development.

He is also cofounder of Hampton Venture Partners and CarbonMine. CarbonMine and BlockTrac are web 3.0 technology partners. They build front end applications hosted on the blockchain and develop the future technology platforms to transform the interactions between companies, stakeholders and consumers.

The views expressed in this article do not reflect the position of the IoD unless explicitly stated.

Contribute your perspectives and expertise on an area of governance to the IoD membership and governance community. Contact us mail@iod.org.nz